A pay stub is more than just a piece of paper; it's a crucial document for managing your finances. It provides vital insights into your income, from earnings breakdown to deductions and net pay. Don't miss out on its benefits! Easily track your earnings using a free pay stub PDF form from PDFSimpli. Stay organized and in control of your finances.

4.5 out of 5 based on 4,003 reviews

September 4, 2024 by Lisa Bowlin

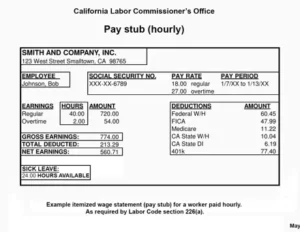

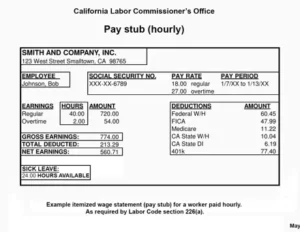

In the world of financial management, certain documents play a pivotal role in maintaining accurate records and ensuring the smooth operation of both personal and business financial systems. Among these critical documents, the pay stub stands out for its importance. Using a free pay stub PDF form from a reliable source like PDFSimpli can significantly simplify the task of generating professional, accurate pay stubs. This article provides an in-depth look into the utility of the free pay stub PDF form, discussing its purpose, benefits and implications for different users. A pay stub, paycheck stub or earnings statement is a detailed document that provides essential information about an employee’s earnings for a specific pay period. When you receive your paystub, you’ll notice it contains information that helps you understand your net and gross income and deductions.

- Regular Wages: The amount you earn based on your regular hourly rate or salary. - Overtime: Additional pay you earned for working more than your regular hours. - Bonuses and commissions: Any extra compensation you earned through bonuses or commissions. - Paid time off (PTO): The total PTO hours you took during the pay period and its corresponding value. This could include sick leave and vacation leave.

- Federal income tax: This is the amount withheld to cover federal income tax obligations. - State Income tax: If applicable, this is the amount withheld to cover state income taxes. - Social Security tax: This is a percentage of your earnings paid into the Social Security program. - Medicare tax: This is a percentage of earnings paid into the Medicare program. - Health insurance premiums: This is the portion of health insurance cost paid through payroll deductions. - Retirement contributions: If you contribute to a retirement plan, this deduction reflects those contributions.

Understanding your paystub is essential for managing your finances effectively. By reviewing each section carefully, you can ensure that your earnings, deductions, and taxes are accurately reflected. If you have any questions or concerns about your paystub, don't hesitate to reach out to your employer's HR department or accounting team for clarification.

Filling out a paycheck stub PDF form with PDFSimpli is extremely useful for individuals seeking to know relevant income information for themselves or to provide to their employees. Income stubs generally contain information regarding the employer‘s tax status, employee‘s earnings, gross pay, online pay (direct deposit), employee payroll taxes and other taxes retained, employee‘s length of employment and pay frequency. These stubs are useful for helping individuals determine consistent payments in any credit arrangement, including home leases, car purchases, mortgage loans, and credit card payments. Pay stubs are generally provided by an employer but may also be used personally by individuals such as contractors and self-employed workers to track their income. If you want to fill out a free paycheck stub PDF form, use this template using PDFSimpli.

Step 1: Download the free paycheck stub PDF form from a reputable website or word processor and gather relevant information. For employers and employees, the information needed for the process includes the employee's Social Security Number, year-to-date earnings, earnings for the last pay period, date of pay period, Employer Identification Number (EIN), employer name and address and tax amounts for each withholding section. Step 2:Fill in the employer’s and employee’s addresses before inputting other values. If your work is lost in any way, this information will auto-populate. Step 3: All the information gathered in Step 1 should now be entered into the pay stub PDF. If a section does not apply or you are completing the form as a self-employed person), you can delete it by left-clicking on it and choosing the option to delete. Step 4: Calculate any deductions that should be removed from the check. By entering the address of the employee and employer in the first step, these values should automatically populate based on the tax percentage in the state. However, if there are errors, you can alter the percentage. Regardless, be sure the values are represented accurately because they are important when establishing proof of income. Step 5: Save or print the document for your records. If you want to continue this process regularly (which we recommend), select the option to add payment records continually. This way, the information that remains the same won’t have to be re-entered the next time you log in to create a stub. You will simply need to enter the values for the new payment period.

You can use PDFSimpli’s free paycheck stub PDF form when you want to establish the amount of money you receive from your work. For contractors and self-employed individuals, these documents can help you track your income and other dollar amounts, such as anticipated owed taxes. Using our free paycheck stub PDF form, you can place all client payments into one stub to establish a set pay schedule for each month of work. Even traditional W2 employees can use the free pay stub PDF form to track information personally. PDFSimpli’s pay stub PDF allows you to verify your data on your timetable.

Neglecting to provide accurate pay stubs to employees can lead to negative consequences, ranging from minor personnel issues to serious legal complications. On one end of the spectrum, it may cause confusion and payment disputes, potentially leading to strained relationships between employers and employees. On the other end, failure to comply with labor laws regarding pay stub requirements can result in legal action and hefty fines from the U.S. government.

A well-maintained pay stub system is essential for effective financial tracking for businesses and individuals. Without proper records of employee compensation, monitoring and managing finances is impossible. Moreover, when it comes to tax compliance, pay stubs play a vital role in a company, ensuring the accuracy of taxes withheld and reported to the Internal Revenue Service and state tax authorities. Failing to provide correct pay stubs can lead to errors in tax filings, potentially leading to penalties from these tax authorities.

Using a professional pay stub template is crucial for businesses to maintain consistency in documentation. A standardized format creates a professional image for the organization and builds employee trust. Additionally, a well-designed pay stub template ensures that all essential information is included, reducing the risk of errors and disputes over earnings and deductions.

The versatility and convenience of our free pay stub PDF form make it easy to use, whether you are an employer, freelancer, contractor, or someone who just wants to track your income. This tool is for everyone who wants to document income and track financial management. The versatility and convenience of the free pay stub PDF form make it accessible and beneficial to a wide range of users. Whether you are an employer, self-employed individual, freelancer, or simply someone who needs to track their income, this tool caters to diverse needs in income documentation and financial management.

There are many times when using our free pay stub PDF form is appropriate, such as maintaining accurate financial records and ensuring transparency in various aspects of personal and business finances. These stubs can be crucial for individuals and organizations in maintaining their financial records related to income and deductions. Pay stubs are routine documents for maintaining comprehensive financial records. They offer a wealth of information about an individual’s earnings, tax obligations and employment status. For businesses, pay stubs contribute to effective payroll management and tax compliance. Whether applying for financial services, validating income or resolving payment discrepancies, pay stubs provide essential documentation to support various financial activities. Earnings tracking: Pay stubs provide a detailed breakdown of an individual’s earnings for a specific pay period. You can track your income over time by referencing these documents, allowing you to budget effectively, plan for expenses and make informed financial decisions. For businesses, pay stubs offer a clear picture of employee compensation, making it easier to manage payroll and analyze labor costs. Identifying tax obligationss: Pay stubs are indispensable at tax time They contain information about tax withholdings, including federal and state income taxes, Social Security taxes and Medicare taxes. These details are crucial for accurately filing income tax returns and ensuring compliance with tax regulations. Employers also rely on pay stubs to calculate and report payroll taxes to appropriate tax authorities. Validating employment and income status: Pay stubs document each worker’s employment status and proof of regular earnings, which can be crucial for multiple purposes. For example, when a person applies for mortgages or rental agreements, lenders and landlords often request pay stubs as evidence of steady income and financial stability. Easy access to these documents via PDFSimpli’s pay stub form streamlines the application process and can instill confidence in lenders and landlords that you can pay your housing costs. Supporting financial transactions: Pay stubs are valuable in other financial transactions and housing applications. They may be required, for example, when opening new bank accounts, obtaining credit cards or filing for a loan. By presenting your pay stubs as proof of your income, you enhance your financial credibility and increase your chances of securing favorable terms and conditions in financial agreements. Resolving discrepancies: Pay stubs are crucial in resolving payment discrepancies between employers and employees. If there are issues with an individual’s paycheck, such as missing wages or incorrect deductions, pay stubs clearly record the earnings breakdown. They are a reliable reference for proving accuracy or rectifying errors, thus ensuring that employees receive accurate compensation. In summary, pay stubs are not just routine documents but vital assets in maintaining comprehensive financial records. They offer a wealth of information about an individual's earnings, tax obligations, and employment status. For businesses, pay stubs contribute to effective payroll management and tax compliance. Whether applying for financial services, validating income, or resolving payment discrepancies, pay stubs provide essential documentation to support a wide range of financial activities.

A. Regularity in generating pay stubs One reason is that pay stubs should be generated regularly, not occasionally. With each payroll cycle, a new pay stub should be issued to provide employees with detailed insight into their earnings, deductions and net pay. Regular pay stubs promote transparency and trust between employers and employees. They also give individuals insights into income and budgeting needs. B. Compliance with legal requirements Another important reason employers regularly provide pay stubs is because they are legal in many states. They ensure transparency in the calculation of wages and deductions. In some localities, failing to provide pay stubs can result in hefty fines and legal consequences.

Filing taxes without a W-2 for employees or proof of income, such as Form 1099 for freelancers, is challenging but not impossible. If you find yourself in a situation where you don’t have a W-2 or Form 1099, here are some steps to help you file your taxes accurately:

Remember that filing your taxes accurately and on time is essential to avoid penalties and interest payments. If you need more time to gather your tax documents or have specific questions about your situation, don’t hesitate to contact the Internal Revenue Service, your state’s Department of Revenue or Finance or seek professional advice.

Generating accurate, professional pay stubs is an integral part of financial documentation. Employers and self-employed individuals can all benefit from using the free pay stub PDF form offered by PDFSimpli. It is a reliable, cost-effective solution that promotes transparency and consistency in payroll management. You can download and start using this tool today to generate your pay stubs seamlessly and maintain your financial records professionally and accurately.

Although they share similarities, a pay stub and a check stub serve different purposes. A pay stub is a document provided with each paycheck that details the breakdown of earnings and deductions. It provides an itemized account of an employee's pay for the pay period. On the other hand, a check stub is attached to a physical paycheck and serves as proof of payment.

Yes, self-employed individuals can use PDFSimpli's pay stub generator to create accurate paycheck stubs for financial planning, tax purposes, and loan applications. PDFSimpli streamlines the process, making it easier to keep track of income and expenses. Whether you are an employee, employer, or self-employed, PDFSimpli's pay stub generator is a valuable tool. Visit PDFSimpli for more information.

Independent contractors can create professional-looking pay stubs using PDFSimpli. It's an easy and fast way to record payments and benefits both contractors and businesses, especially during tax season or audits. While not all businesses provide pay stubs to independent contractors, PDFSimpli's financial templates are tools can fill that gap, ensuring accurate records of all payments

Yes, a paycheck stub is often required for renting an apartment to prove income. If you need a paycheck stub quickly or don't have one from your employer, PDFSimpli offers a free, secure way to generate one. It can save you time during the rental application process and help you meet landlords' requirements. If you need an ADP paycheck stub specifically, use PDFSimpli's ADP paycheck stub generator

Using PDFSimpli completing a pay check stub is as simple as downloading and filling out our easy to use pay-stub template.

Self-employed individuals can show proof of income by using PDFSimpli's free template pay check stubs, banking statements, or tax returns.

Yes, there are free pay stub generators available online, and PDFSimpli is one of the best among them. It provides an easy and affordable means to generate professional pay stubs, saving you the time and hassle of creating these documents manually.

FICA stands for "Federal Insurance Contributions Act," and it refers to the payroll taxes withheld from your paycheck to fund Social Security and Medicare programs. FICA taxes are split into two components: Social Security tax and Medicare tax. The amount withheld is a percentage of your earnings and is used to support these federal programs that provide retirement and medical benefits to eligible individuals.

Free pay stub PDF forms often allow for a certain level of customization to cater to specific needs but with PDFSimpli you can customize a pay stub to fit your needs. You can edit the PDFSimpli form to add company logos or change the layout to match your brand. This helps you maintain consistency in your business documents while giving your pay stubs a more personalized touch.